Tobin Q Effect

Beyond adding the focus effect our analy-sis differs from Schmalensees in two related ways. Value ROA and Tobins Q has decreased in 2008 due to impact of the global financial crisis the value of ROA and Tobins Q has increased again in 2010-2011.

Ch 4 Consumption Saving And Investment Abel Bernake

Q Value the stock market places on the firms asset Cost of producing those assets.

Tobin q effect. It describes a condition of investment opportunities of the company or the. Since the most important source of movement in q is the change in stock market prices Tobins theory creates an additional channel by which changes in the stock market may influence the economy through its. The concept of the Q ratio and its effect in predicting investment patterns has garnered much criticism.

In order to estimate the effect of inflation on Tobins q we follow Faria and Mollick 2010 allowing for technical progress and the stock of capital. This is investigated by using multiple regression analysis with ROA CR and ATR as the independent variable. Tobins q is often used to proxy for rm performance when studying the relation between corporate governance and rm performance.

The tax incentives available to individual companies. Positive and significant impact on Tobins Q. The T obin s Q ratio is a r atio devised by James Tobin of Yale.

Similarly when Tobins q is smaller than 1 the value of capital is less than the cost of acquiring it. Dict a negative focus effect. Using the same formula Tobins q for Company B works.

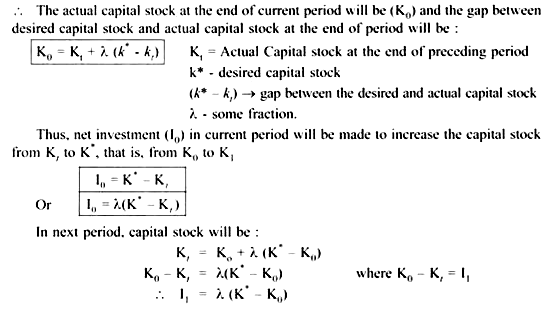

Hence if a firm has a Q ratio greater than 1 it is considered as overvalued according to the hypothesis. Q is Tobins q calculated by Laitner and Stolyarov 2003. When Tobins q is greater than 1 it is profitable to acquire additional capital because the value of capital exceeds the cost of acquiring it.

In effect we trade more detailed data for a better measure of. It also considers a measure used for evaluating companies where a comparison is made between share market and book value especially. We find a negative statistically significant effect between the ERM adaption and Tobins Q while positive effect on Return On Equity of bank performance.

Therefore it is confirmed that as a proxy for the future. Q market value of the firm Replacement cost of capital. So it is not profitable to invest in additional capital.

So researchers can infer and make a synthesis on the basis of theoretical and empirical studies of previous studies as follows. A Return on Assets ROA has a positive effect on stock return Property and Real Estate companies go public in Indonesia. It relies on the concepts of market value and replacement value.

Whereas he looked at firms account-ing returns at the industry level we use Tobins q as a measure of performance and conduct the analysis at the firm level. Several empirical studies have used Tobins Q as a measure of valuation to study the relationship between managerial ownership and firm valuation. 10 q t β 0 β 1 Ζ t β 2 Δ p t β 3 K t ε t where.

Why Does Tobins Q Ratio Matter. Q is found to be a significant factor in the explanation of company investment although its effect is small and a careful treatment of the dynamic structure of Q models appears critical. These papers include Morck Shleifer and Vishny 1988 and McConnell and Servaes 1990 that offer support for both the positive alignment effect and the negative entrenchment effect.

For several decades Tobins q has been one of the most important concepts in business law and policy for examining how various regulatory and corporate governance provisions affect firm value and therefore economic welfare. A Tobins Q above 1 means that the firm is worth more than the cost of its assets. Tobin Q Ratio is used as the measure for Firm Value to investigate whether Financial Ratios has effect on Firm Value or not.

Achievement which is measured by Tobins Q indicator where this indicator adopts the tangible and intangible fac-tors which affect a companys value. This study also shows that DGOVERNMENT and DERM play a significant factor in explaining the performance in Indonesia banks. However our theoretical and em-pirical analysis demonstrate that Tobins q does not measure rm performance since underinvestment increases rather than decreases Tobins q.

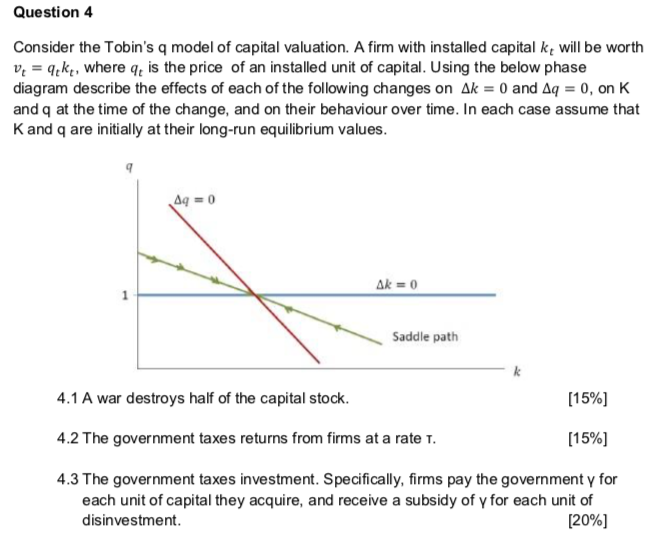

James Tobin hypothesized that the market value of a firm should ideally be equal to the cost or replacement value of its assets. Z is a control variable for the state of technology and we consider in turn the simple time trend or real GDP adjusted by efficiency hours. TBQF was used to erase the problem of endogeneity because at the same time Tobins Q became the dependent and independent.

James Tobin was the first person to explain this relation between the stock market and investment and that is why it is also referred as Tobins q theory. While the minimum value of Tobins Q occurred in 2008. In addition to Q both cash flow and output.

Given the following data calculate the Tobins q. Tobins Q Tobins Q is an indicator used to measure the com-pany value which shows the management perfor-mance in managing the companys assets from the investment perspective. Model Summary Based on Table Model Summary The magnitude of the effect on Tobins Q ROA of 146 and ROA outside factors.

Valuation of Corporate Profits. Tobins Q-Notion TBQF was counted after the equation of Tobins Q was obtained which was then used as the independent variable to find out the effect towards the sectoral share price index two-stage least square. Tobins q Company A 12500000 20 360000000 225000000 360000000 104.

Implications of Tobins q. Tobin s Q is defined as the ratio of the market value of a firm divided by the b ook value of its assets 2. The Q ratio also known as Tobins Q measures whether a firm or an aggregate market is relatively over- or undervalued.

As an alternative to To-. Because Tobins premise is that firms should be worth what their assets are worth anything above 10 theoretically indicates that a company is overvalued. Overall our empirical analyses demonstrate that Tobins q ratio has significant effect on the firms future operating performance.

Only Company A has market value of debt available so we should use the Tobins q formula which uses book value of debt to work out the ratios. When the Tobins Q ratio is between 0 and 1 it costs more to replace a firms assets than the firm is worth.

Pdf Corporate Governance And Tobin S Q As A Measure Of Organisational Performance

Valuation Basics Market Vs Book Value And The Argument For Both

Pdf Liquidity When It Matters Qe And Tobin S Q

Pdf Liquidity When It Matters Qe And Tobin S Q

Tobin S Q Theory Of Investment Download Scientific Diagram

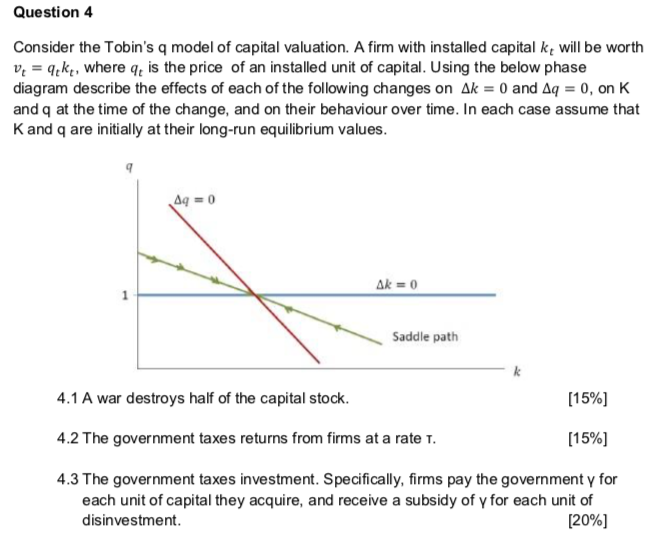

Question 4 Consider The Tobin S Q Model Of Capital Chegg Com

Pdf Corporate Governance And Tobin S Q As A Measure Of Organisational Performance

Tobin S Q Theory Of Investment Download Scientific Diagram

Correlation Between Roa And Tobin S Q Ratio Download Scientific Diagram

Tobin S Q Theory Of Investment With Diagram

Pdf Liquidity When It Matters Qe And Tobin S Q

Tobin S Q Theory Of Investment Youtube

Corporate Governance And Tobin S Q As A Measure Of Organizational Performance Singh 2018 British Journal Of Management Wiley Online Library

Tobin S Q Theory Of Investment With Diagram

Posting Komentar untuk "Tobin Q Effect"