7. Effect Of A Tax On Buyers And Sellers

This places a wedge between the price buyers pay and the price sellers receive. The burden of the tax falls more heavily on the elastic side of the market.

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

This places a wedge between the price buyers pay and the price sellers receive.

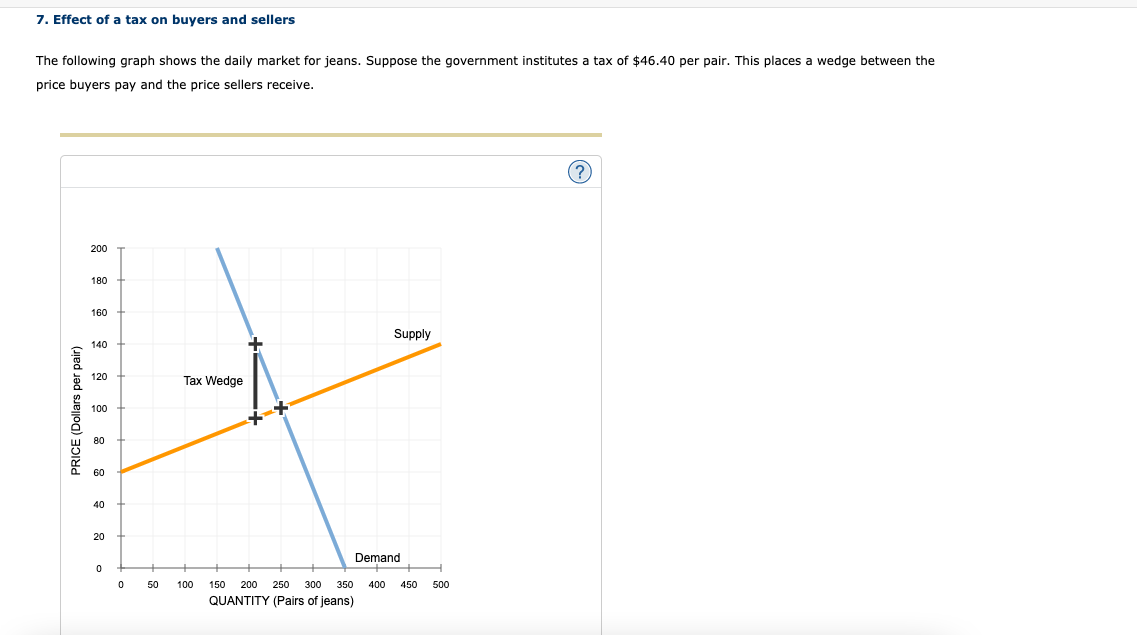

7. effect of a tax on buyers and sellers. Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. This places a wedge between the price buyers pay and the price sellers receive 50 45 40 35 Supply 30 Tax Wedge PRICE Dollars per pair 25 20 15 10 5 0 D TO 20. Homework Ch 06 7.

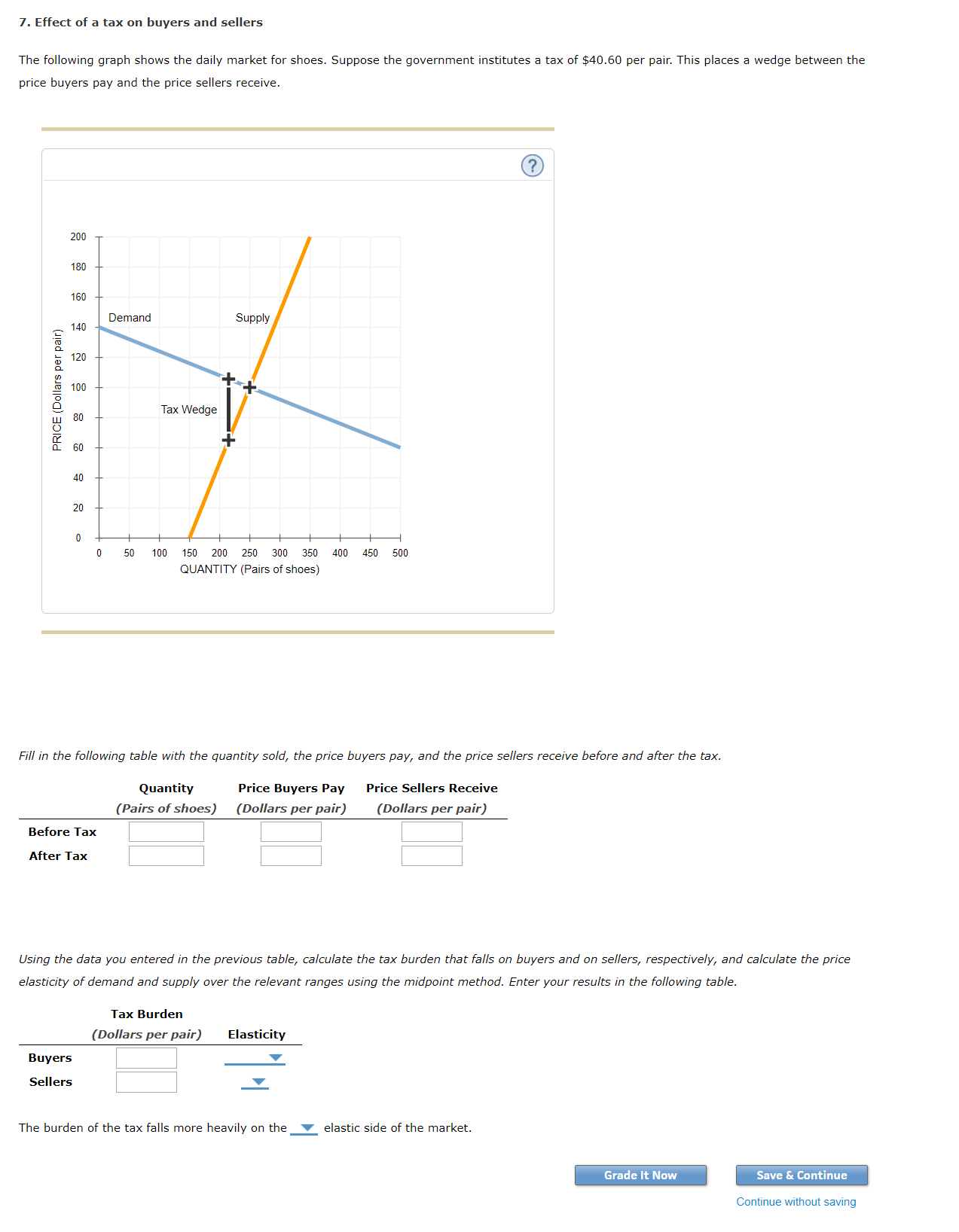

Suppose the government institutes a tax of 4060 per pair. This places a wedge between the price buyers pay and the price sellers receive. The following graph shows the daily market for jeans.

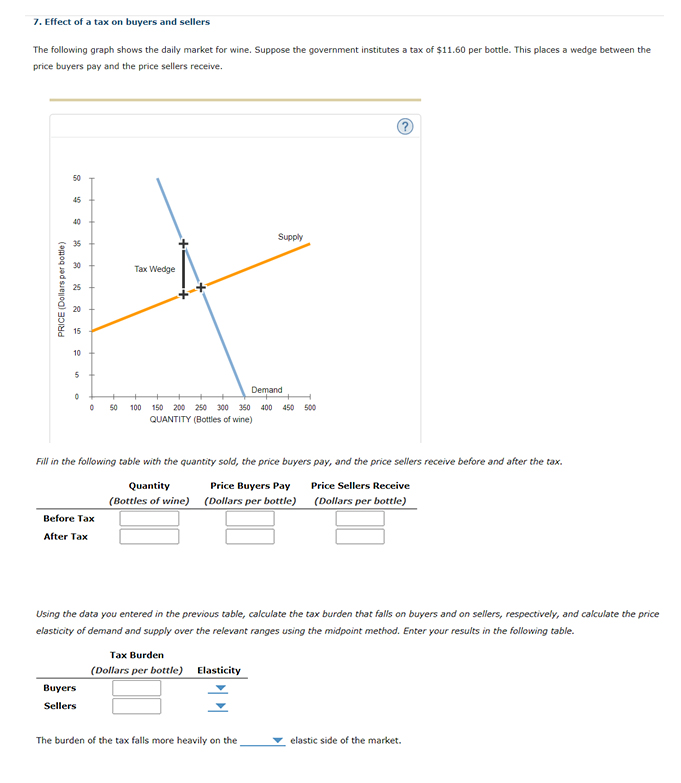

00 T 90 80 Supply 70 60 Tax Wedge A 50 40 30 20 Demand 100 200 300 400 500 600 700 800 900 1000 QUANTITY Bottles of wine. This places a wedge between the price buyers pay and the price sellers receive. Suppose the government institutes a tax of 1160 per pair.

This places a wedge between the price buyers pay and the price sellers receive. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes when a tax on sellers is set at 0 per pair. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes.

Effect of a tax on buyers and sellers The following graph shows the daily market for wine. Effect of a tax on buyers and sellers The following graph shows the daily market for wine. Suppose the govenment institutes a tax of 1160 per pair.

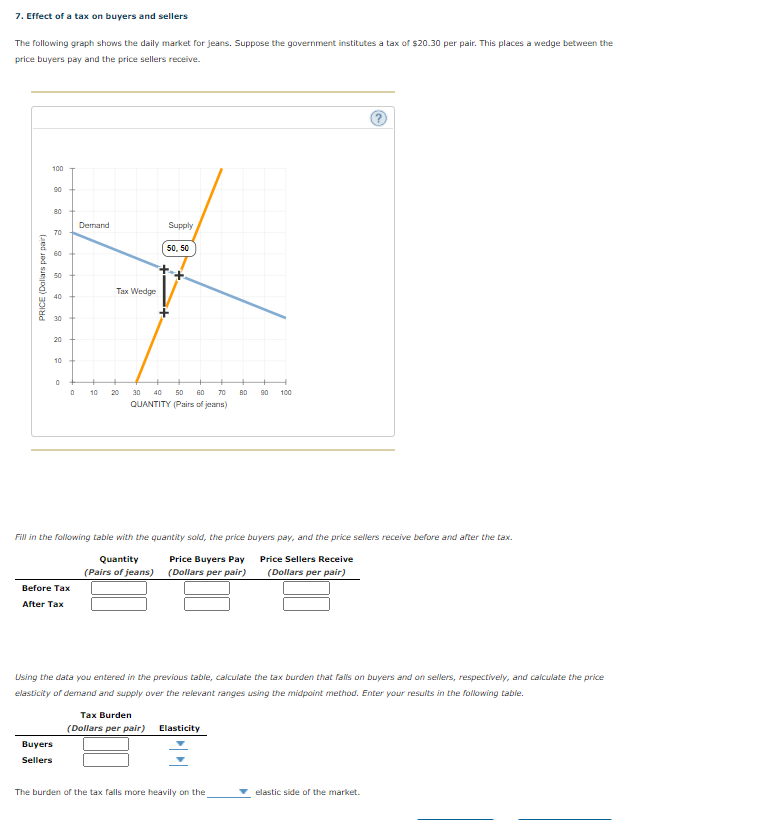

Effect of a tax on buyers and sellers The following graph shows the daily market for shces. Effect of a tax on buyers and sellers. Suppose the government institutes a tax of 2030 per bottle.

50 45 40 Supply 35 30 Tax Wedge PRICE Dollars per pair 10 5 Demand 0 0 10 20 80 90 100 30 40 50 60 70 QUANTITY Pairs of. So taxes are to be paid entirely by the buyers. Effect of a tax on buyers and sellers The following graph shows the daily market.

Suppose the government institutes a tax of 4060 per bottle. Panel d shows no change in price even after tax is imposed. Suppose the government institutes a tax of 2320 per pair.

Effect of a tax on buyers and bartleby. This places a wedge between the price buyers pay and the price sellers receive. Suppose the government institutes a tax of 2320 per pair.

Suppose the government institutes a tax of 4060 per pair to be paid by the seller. This places a wedge between the price buyers. This places a wedge between the price buyers pay and the price sellers receive.

Suppose the government institutes a tax of. Effect of a tax on buyers and sellers. This places a wedge between the price buyers pay and the price sellers receive.

Suppose the government institutes a tax of 2030 per pair. Suppose the government institutes a tax of 1160 per pair to be paid by the seller. This places a wedge between the price buyers pay and the price sellers receive.

Effect of a tax on buyers and sellers. 1 Answer to 7. Suppose the govenment institutes a tax of 1160 per pair.

Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. 50 T 45 40 Supply 35 30. Economics questions and answers.

The following graph shows the daily market for shoes when the tax on sellers set at 0 per pair. Suppose the government institutes a tax of 2320 per pair. Suppose the government institutes a tax of 1160 per pair.

This places a wedge between the price buyers pay and the price sellers receive. Suppose the government institutes a tax of 1160 per bottle. Effect of a tax on buyers and sellers The following graph shows the daily market for wine.

Effect of a tax on buyers and sellers The following graph shows the daily market for wine. Suppose the government institutes a tax of 1160 per pair. To see the impact of the tax enter the value of the tax in the Tax on Sellers field and move the green line to.

Supply Tax Wedge Demand 50100150200觊300 30 400 450 QUANTITY Pairs of shoes FI in the oowing tabie with the. Effect of a tax on buyers and sellers The following graph shows the daily market for wine. Effect of a tax on buyers and sellers The following graph shows the daily market for shces.

You will not be graded on any changes you make to this graph. This places a wedge between the price buyers pay and the price sellers receive. 100 90 80 Demand Supply 70 60 50 Tax Wedge 30 20 10 0 0 10 20.

This places a wedge between the price buyers pay and the price sellers receive. Effect of a tax buyers and sellers The following. 100 90 Supply 70 60 50 40 30 20 10 Tax Wedge Dermand.

Suppose the government institutes a tax of 1160 per pair. This places a wedge between the price buyers pay and the price sellers receive 50 45 40 35 30 25 20 15 T 10 Tax Wedge Demand 0 100 200 300 400 500 600 700 800 900 1000 QUANTITY Bottles of wine. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes.

100 90 80 Supply 70 Tax Wedge PRICE Dollars per pain 8 8 8 20 10 Demand 0 10 20 80 90 100 30 50 60 70 QUANTITY Pairs of. Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes.

Effect of a tax on buyers and sellers the daily market for jeans. 50 45 40 Supply 35 30 Tax Wedge 25 20 15 10 Demand se 100. Suppose the government institutes a tax of 4060 per pair.

This places a wedge between the price buyers pay and the price sellers receive. Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Effect of a tax on buyers and sellers The following graph shows the daily market for shoes.

Suppose the government institutes a tax of 1160 per bottle. Suppose the government institutes a tax of 2320 per bottle. This places a wedge between the price buyers pay and the price sellers receive.

Effect of a tax on buyers and sellers The following graph shows the daily market for jeans. Suppose the government institutes a tax of 2320 per pair. Effect of a tax on buyers and sellers The following graph shows the daily market for jeans.

Effect of a tax on buyers and sellers The following graph shows the dally market for jeans. This places a wedge between the. This places a wedge between the The following graph shows price buyers pay and the price sellers receive 100 T 90 80 Supply 70 60 Tax Wedge 50 w 40 30 20 10 Demand 10 20 30 40 50 60 70 80 90 100 QUANTITY Pairs of jeans.

Thus greater the elasticity of demand and lower the elasticity of supply greater will be the burden of tax on sellers. Effect of a tax on buyers and sellers The following graph shows the daily market for wine when the tax on sellers is set at 0 per bottle Suppose the government institutes a tax of 1160 per bottle to be paid by the seller Use the graph input tool to help you answer the following questions. So sellers must bear the burden of tax.

0102030405060708090100200180160140120100806040200PRICE Dollars per pairQUANTITY. Suppose the government institutes a tax of 4060 per pair. 200 T 180 160 Demand Supply 140 亩 120 100 Tax Wedge ш80 0 60 М 20 0 100 200 300 400 500 60 700 800.

This places a wedge between the price buyers pay and the price sellers receive.

Answered 7 Effect Of A Tax On Buyers And Bartleby

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Answered 7 Effect Of A Tax On Buyers And Bartleby

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Solved 7 Effect Of A Tax On Buyers And Sellers The Chegg Com

Orange Micro Macro Chapter 6 Supply Demand And Government Policies

Answered 7 Effect Of A Tax On Buyers And Bartleby

Solved Effect Of A Tax On Buyers And Sellers The Following Chegg Com

Orange Micro Macro Chapter 6 Supply Demand And Government Policies

Solved Effect Of A Tax On Buyers And Sellers The Following Chegg Com

Solved 7 Effect Of A Tax On Buyers And Sellers Captured Chegg Com

Posting Komentar untuk "7. Effect Of A Tax On Buyers And Sellers"